All Categories

Featured

Table of Contents

Degree term life insurance policy is a policy that lasts a set term usually in between 10 and three decades and features a degree death benefit and level costs that stay the same for the entire time the plan is in impact. This means you'll know precisely how much your repayments are and when you'll need to make them, enabling you to spending plan as necessary.

Level term can be a terrific alternative if you're looking to get life insurance coverage for the very first time. According to LIMRA's 2023 Insurance Barometer Research Study, 30% of all adults in the United state demand life insurance policy and don't have any kind of kind of plan. Degree term life is predictable and inexpensive, which makes it one of the most popular sorts of life insurance.

A 30-year-old man with a similar account can anticipate to pay $29 monthly for the very same protection. AgeGender$250,000 coverage amount$500,000 insurance coverage amount$1 million protection amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Approach: Ordinary month-to-month prices are computed for male and women non-smokers in a Preferred wellness classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance coverage plan.

Rates may vary by insurance firm, term, coverage amount, wellness course, and state. Not all plans are available in all states. It's the most affordable type of life insurance coverage for the majority of people.

It enables you to budget and prepare for the future. You can easily factor your life insurance policy into your budget plan because the premiums never ever change. You can prepare for the future equally as quickly because you understand exactly just how much cash your loved ones will receive in case of your lack.

What is Life Insurance Level Term? Understanding Its Purpose?

In these situations, you'll normally have to go through a brand-new application process to obtain a much better rate. If you still need coverage by the time your level term life plan nears the expiry date, you have a few alternatives.

A lot of degree term life insurance policy policies come with the option to restore coverage on a yearly basis after the initial term ends. The price of your policy will be based on your current age and it'll enhance every year. This might be a great alternative if you just require to extend your protection for 1 or 2 years or else, it can get costly quite swiftly.

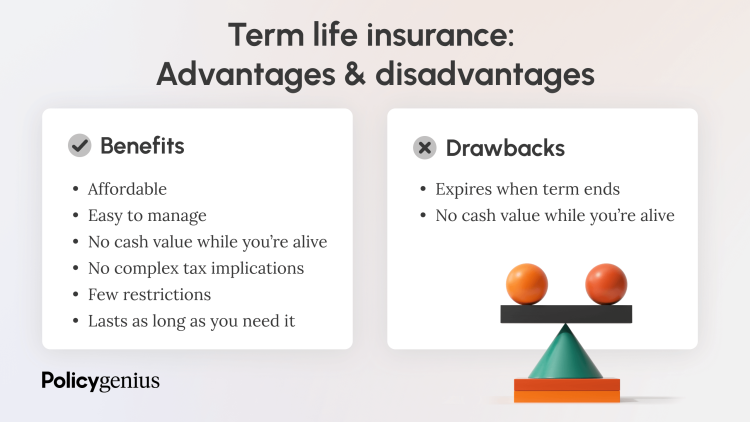

Level term life insurance coverage is one of the most affordable insurance coverage alternatives on the marketplace since it supplies basic protection in the form of survivor benefit and only lasts for a collection duration of time. At the end of the term, it runs out. Whole life insurance policy, on the various other hand, is substantially extra expensive than level term life due to the fact that it does not expire and features a money value attribute.

Not all policies are readily available in all states. Degree term is a wonderful life insurance option for most people, yet depending on your protection demands and personal situation, it might not be the best fit for you.

Annual eco-friendly term life insurance policy has a regard to just one year and can be renewed yearly. Yearly eco-friendly term life premiums are initially reduced than level term life costs, yet rates rise each time you restore. This can be an excellent choice if you, as an example, have just stop smoking cigarettes and need to wait two or three years to obtain a degree term policy and be eligible for a lower rate.

, your fatality advantage payout will reduce over time, however your settlements will certainly stay the exact same. On the various other hand, you'll pay more in advance for much less coverage with an enhancing term life policy than with a level term life policy. If you're not certain which kind of plan is best for you, working with an independent broker can assist.

As soon as you have actually decided that degree term is best for you, the next action is to acquire your policy. Below's how to do it. Determine just how much life insurance policy you require Your insurance coverage amount need to provide for your family members's lasting financial needs, including the loss of your revenue in case of your death, as well as debts and daily expenditures.

The most preferred kind is now 20-year term. The majority of business will not sell term insurance to an applicant for a term that finishes previous his/her 80th birthday. If a policy is "renewable," that implies it continues active for an added term or terms, as much as a defined age, even if the health and wellness of the insured (or other aspects) would certainly cause him or her to be denied if he or she looked for a new life insurance policy plan.

So, premiums for 5-year renewable term can be degree for 5 years, after that to a brand-new rate showing the brand-new age of the guaranteed, and so on every five years. Some longer term plans will certainly ensure that the premium will certainly not enhance during the term; others do not make that assurance, allowing the insurance policy company to raise the rate during the policy's term.

What is Level Term Life Insurance and Why Choose It?

This means that the plan's owner has the right to transform it right into a permanent type of life insurance policy without additional proof of insurability. In many types of term insurance coverage, including home owners and car insurance policy, if you have not had a claim under the policy by the time it ends, you obtain no reimbursement of the premium.

Some term life insurance policy customers have been unhappy at this outcome, so some insurance companies have actually produced term life with a "return of premium" function. The costs for the insurance coverage with this function are typically substantially more than for policies without it, and they generally need that you maintain the plan in force to its term otherwise you waive the return of premium advantage.

Level term life insurance policy premiums and fatality advantages remain consistent throughout the plan term. Level term life insurance is usually extra inexpensive as it does not build cash value.

While the names commonly are used interchangeably, level term coverage has some important distinctions: the premium and death benefit stay the very same throughout of protection. Level term is a life insurance policy plan where the life insurance policy costs and fatality benefit continue to be the exact same throughout of insurance coverage.

Latest Posts

All Life Funeral Insurance

Open Care Final Expense Plans Reviews

Funeral Insurance California